On this page

Freight feels complex until you see the whole picture. This evergreen, visual guide shows the documents you’ll touch, how to think about duties, and how Incoterms divide responsibilities—so you can ship with confidence.

Snapshot

What matters, at a glance

Documents you’ll likely use:

- Commercial Invoice & Packing List

- Transport doc: B/L, AWB, CMR, CIM

- Origin, HS Code, and any licenses

Duties depend on: HS Code × Customs Value × Country + preference programs (e.g. EU-UK TCA). Start with your 6-digit HS, then check local tariff.

The 7 core documents

- Commercial Invoice — value, seller/buyer, Incoterm.

- Packing List — pieces, weight, dimensions, marks.

- Transport Document — B/L (ocean), AWB (air), CMR (road), CIM (rail).

- Certificate of Origin — eligibility for preferences.

- HS Codes — classification drives duty rate.

- Licenses/Permits — if controlled goods.

- Insurance — match the Incoterm risk point.

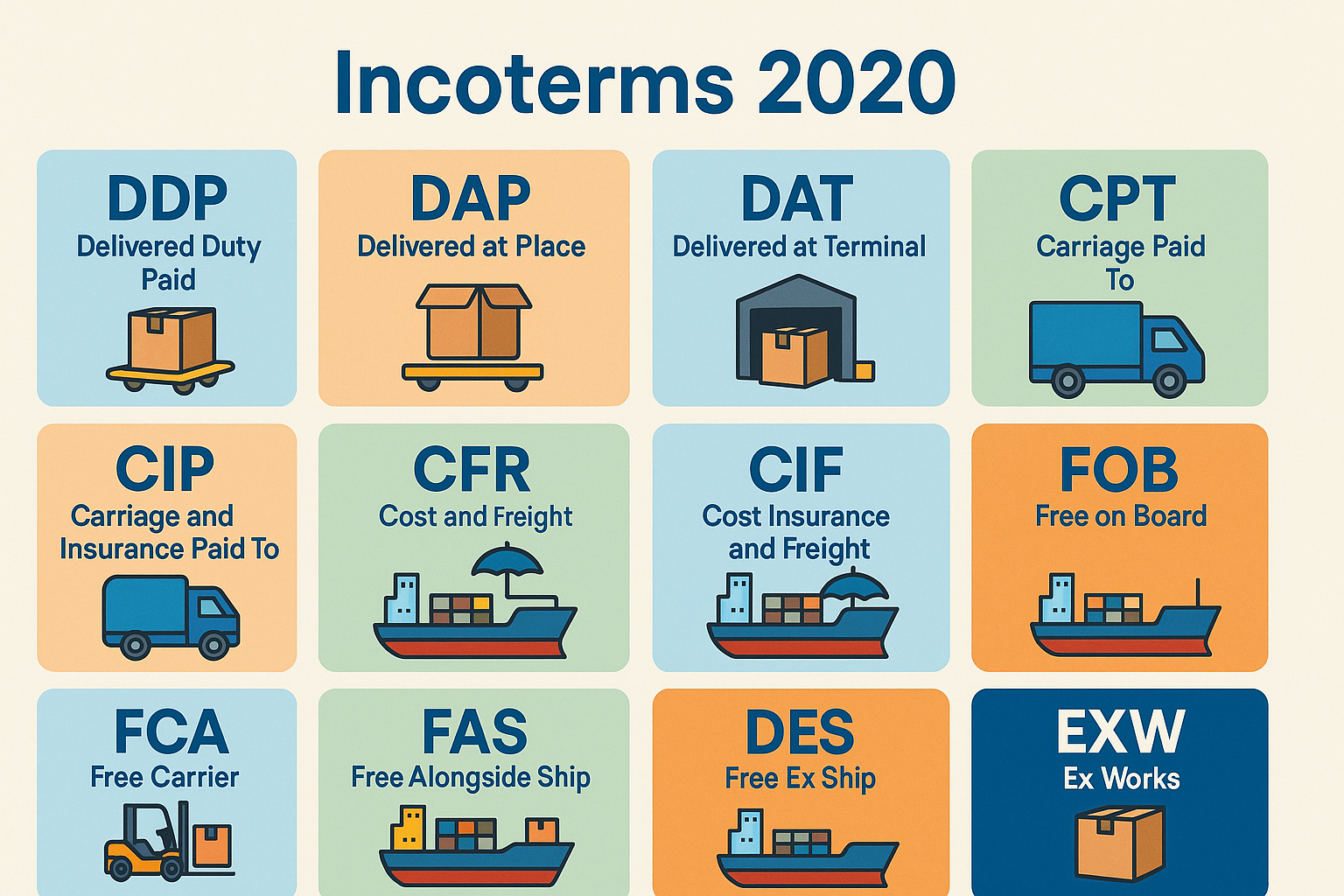

Incoterms® explained in one view

| Term | Where risk passes | Key buyer costs | Good for |

|---|---|---|---|

| EXW | Seller’s door | All transport & export formalities | Experienced buyers with origin control |

| FCA | Carrier at origin | Main carriage, insurance, import | Most common, flexible |

| CIF/CIP | On board / first carrier | Import duties & taxes | When seller buys insurance |

| DDP | Buyer’s door | — | No-surprise delivery for buyer |

Tip: always pair the Incoterm with a named place: e.g., FCA Hamburg Terminal.

How to estimate duties (in plain English)

- Classify at 6 digits (HS); add national digits if required.

- Customs Value: typically CIF or transaction value (jurisdiction-specific).

- Rate from the tariff; apply any agreement (e.g., zero duty if origin qualifies).

Pack & mark like a pro

- Use readable export marks that match docs.

- Show gross/net weight, dims, and piece count.

- Apply “This Side Up”, “Keep Dry” where relevant.

Save this: mode trade-offs

ModeMatch rule of thumb: if value-to-weight is high or deadlines are tight, bias to air. If volume is high and lead time mellow, bias to ocean. Bridge gaps with road/rail; use courier for small/urgent.

0 comments

Leave a commentNo comments yet — be the first to share your thoughts.

Write a commentLeave a comment